The easiest way to freelance in Italy

Open and manage smoothly your VAT under Flat-Rate or Simplified regime with Xolo all-in-one digital solution. Our English speaking team of tax experts guides you step-by-step. Starting from only €36/month.

Freelancing in Italy is finally stress-free:

bye bye bureaucracy!

Manage easily every aspect of your VAT: a fast and efficient platform for invoicing and accounting management, plus a team of English speaking tax experts always by your side.

Free registration and VAT opening in 1 day

From the very first steps we are by your side. An English speaking accountant sets up your VAT in just 24 hours.

Smooth invoicing and accounting

An easy dashboard to send unlimited invoices, manage accounting, store documents.

Tailored support with extra care

Access our team of freelance taxation specialists, ready to answer your questions simply, effectively, and always in under 24h.

Your Commercialista who speaks English

Our teams of accounting and taxation experts will take care of everything your freelance business needs.

With Xolo, you’ll have:

Maximize your earnings with the best plan

Simplified or Flat-rate regime? We carefully analyze your situation and guide you from the beginning to choose the best Regime option.

Flat-Rate regime (Forfettario)

Ideal for freelancers and micro-businesses with annual revenue up to €85,000, few expenses to deduct, looking for simplicity and reduced taxation.

Simplified regime (Semplificato)

Ideal for professionals and small businesses with higher revenues, many deductible expenses, who need to manage VAT. Compatible with “Impatriati tax relief”.

The all-in-one online solution

Business Registration

Register your VAT in 1 day

Dealing with Italian tax system is complicated? Xolo kicks bureaucracy out so you can jump right in!

“Xolo makes the complicated and boring process of managing a Partita IVA incredibly easy. Having a dedicated account manager has been a game changer.”

Invoicing tool

Send invoices in a few clicks

Easily create and send unlimited electronic invoices in 2 minutes, to your Italian and International clients.

Conveniently organize your customers' data in your address book, to speed up the creation of each new invoice and organize your registers.

Tax and Accounting

Everything under control

An intuitive dashboard to easily track expenses and earnings, store important documents, view personalized reports. And a helpful calendar so you won’t miss any important deadline.

World class support

Always by your side

Our customers are as proud of our support as we are – enjoy fast, reliable and informed support from a team of experts. All in English.

“This company is a god send if you need to open a partite IVA but are aren't an Italian native speaker. They are extremely helpful and responsive.”

Get the support you need to run a company in Italy 🇺🇸🇬🇧

Enjoy your freedom in 3 easy steps

Answer a couple of questions (3 min)

Create your account for free and fill our a short form with information about your business - it will help us understand if Xolo is the right solution for you and how we can support you best.

Choose your plan

Our plans are designed to cover a wide range go freelance needs in Italy. We support both Flat-rate and Simplified regime, and we’ll guide you in the choice.

Start invoicing in 24 hour

Are we the perfect match? If so, great! We set you up in 1 day, and you can start invoicing and enjoying the freedom of managing everything in one place.

Positive Vibes

Forfettario Regime (Flat-Rate)

Semplificato Regime (Simplified)

With both subscriptions:

Add-ons: take just what you need

Model Redditi PF

Did you have a VAT number in 2023? Don't worry, we'll take care of it. If you already have or choose an annual plan we will fill and send your Model Redditi PF 2024 (income 2023) for you!

180€ VAT includedVAT termination

Want to bring your freelance journey to an end? We take care of your cancellation with the tax authorities so that you can dedicate yourself to all your new projects!

100€ VAT includedVariation in sole proprietorship

Has something changed? Do you need to update your business data? We take care of all the requirements, so you can focus only on your future steps!

Active repentance

Did you forget a payment deadline or made a mistake? No panic, we'll take care of reducing your penalty and regularizing your tax position.

10€ VAT includedDidn’t find what you were looking for? Check out more additional services here

Xolo Italia S.r.l. is not an accountant. It is a company that allows you to manage your VAT admin through a proprietary software platform and a dedicated support service. All confidential and tax consultancy activities are managed by our partner accountants, enrolled in the Register of Chartered Accountants.

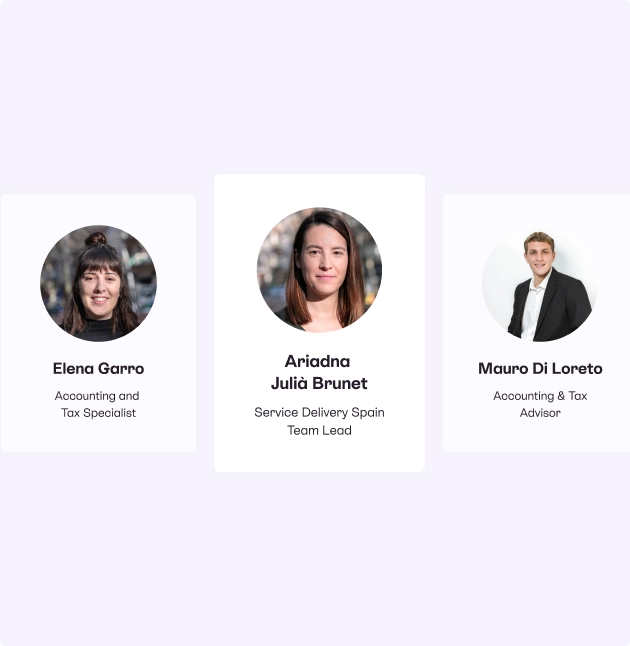

An expert team with all the right connections

Your business will be in the capable hands of our expert accounting team. Each of them has expansive knowledge of local and international taxation and 10+ years of experience working with freelancers.

We’re accredited by the Agenzia delle Entrate, which is the governing body of the Italian Tax System. This accreditation gives us full authority to prepare and submit your administrative practices and declarations.

We cooperate with the Italian Chamber of Commerce, the recipient body for the registration of sole proprietorships in Italy. This is why we can best handle the paperwork for registration with the Chamber and all other related bodies (INPS, INAIL, AdE).

Join 150K+ freelancers who have already said goodbye to bureaucracy

It's time for the freelance experience you deserve: independent and easy! Discover the new way to manage your accounting and say goodbye to worries.