Incentive reduction 50% Art-Com 2025

User manual for workers who declare business income, even under the flat-rate regime, and who register for the first time during the year 2025 in one of the special autonomous management of artisans and commercial activities, as

1. owners of sole proprietorships;

2. family collaborators;

3. working partners, at the time of first entry into the company.

The start-up of the company or entry into the corporate structure must take place in the period between 1 January 2025 and 31 December 2025. The contribution reduction is an alternative to other current facilitation measures that provide for the reduction of the rate

Summary

- Introduction

- What is it used for?

- Who is it aimed at?

- How to use

- System access

- Enabled features

- Entering a new application

- Filter tab: Selection of contribution position

- Contribution position tab

- Workers tab

- Tab De Minimis

- Summary tab

- Viewing the list of questions

- Detailed view of questions

- Introduction

a. What is it for:

Article 1, paragraph 186 of Law No. 207 of 30 December 2024 (the so-called Budget Law for the year 2025) recognises a 50 per cent contribution reduction on the social security contribution for disability, old age and survivors due by those who enrol for the first time during the year 2025 in the special autonomous management of artisans and commercial activities and declare business income, even in the flat-rate regime.

b. Who is it for:

The benefit is aimed at workers who declare business income, even under the flat-rate regime, and who register for the first time during the year 2025 in one of the special autonomous management of artisans and commercial activities as 1. owners of sole proprietorships; 2. family collaborators; 3. working partners, at the time of first entry into the company. The start-up of the company or entry into the corporate structure must take place in the period between 1 January 2025 and 31 December 2025. The contribution reduction is an alternative to other current facilitation measures that provide for rate reductions

c. How to enjoy:

In order to recognize the contribution reduction, interested parties submit a specific application to INPS using the request form within the Facilitation Portal.

d. System Access

The "Facilitation Portal" system is available on the Institute's internet portal (www.inps.it) at the following path:

Home 🡪 Processes 🡪 Performance and Services 🡪 Services for companies and consultants 🡪 Facilitation Portal (formerly DiResCo).

Access to the application will take place after enabling the user through the Institute's authentication system.

e. Enabled features

When using the functions, the relative buttons will be enabled or disabled based on the processing status of the questions.

In the table, the matrix of enabled functions:

Function |

Entering a new application |

Viewing the Questions List |

Detailed view of questions |

- Entering a new application

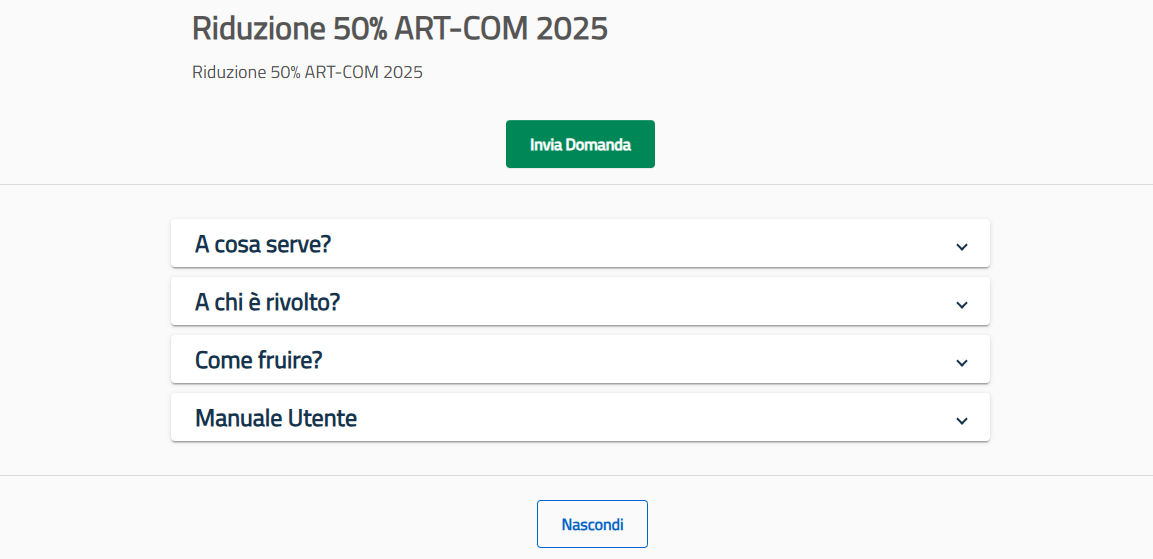

After selecting the "50% ART-COM 2025 Reduction" incentive within the "Featured Incentives", by clicking on the "Inviada Domanda" button on the relevant Home Page, the user can proceed to enter a new application for admission to the benefit.

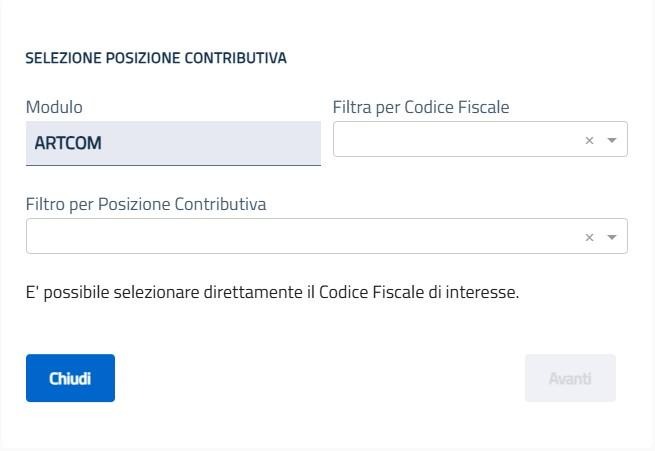

- Filter tab Selection of contribution position

As a first step, the following screen will be shown:

You can:

- Directly indicate the tax code of interest and then select the contribution position within the dedicated filter.

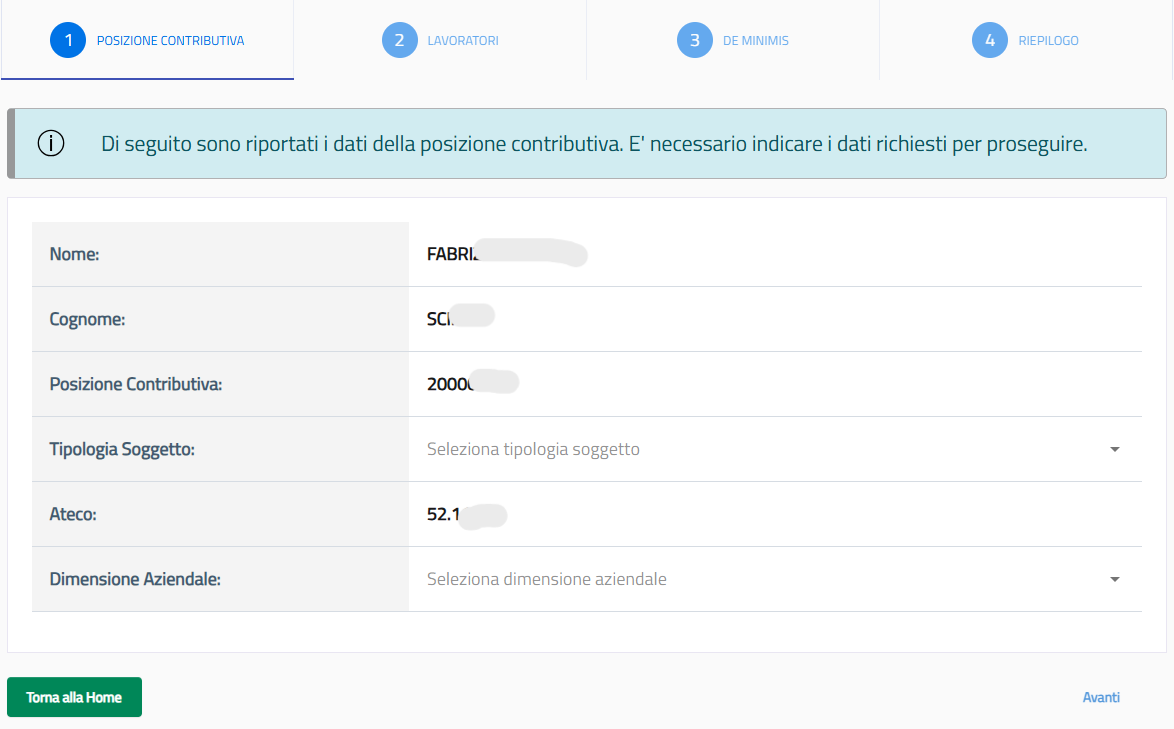

- Contribution Position Tab

If the status of the tax code is compatible with the exemption request, the user will reach the following screen (Contribution Position Tab), where the fields are present:

- Name;

- Surname;

- Contribution Position: represents the company's contribution position;

- Type of subject: it will be necessary to choose between "Sole Proprietorship and "Company Partner";

- Company Tax Code: It is displayed when "Company Shareholder" is chosen in the previous field.

- Ateco: represents the Ateco code. Here, the user will be able to check which category of economic activity the selected company serial number refers to.

- Company Size: to be selected from Micro, Small, Medium, and Large Enterprises;

If the user no longer intends to continue with the application process, they will have the "Torna alla Home" button available, so that they can quickly return to the Main page.

Pressing the "Avanti" button instead, the user will be redirected to the next screen.

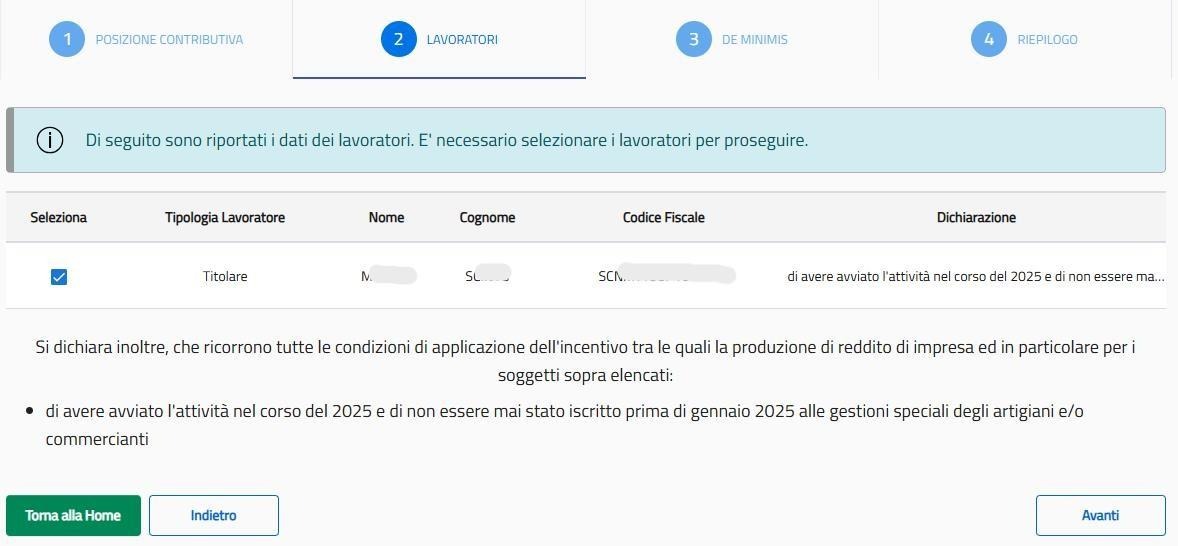

- Workers Tab

After entering the required data in the Contribution Position Tab, the user will see the following screen (Workers Tab):

To continue with the application submission process, it will be necessary to select the workers concerned for the incentive request.

After indicating all the required data in the Workers Tab, clicking on the "Avanti" button will take you to the next screen (De Minimis Tab).

By clicking on the "Indietro" button, it will be possible to return to the previous page (Contribution Position Tab).

To return to the Home, however, simply press the "Torna alla home" button.

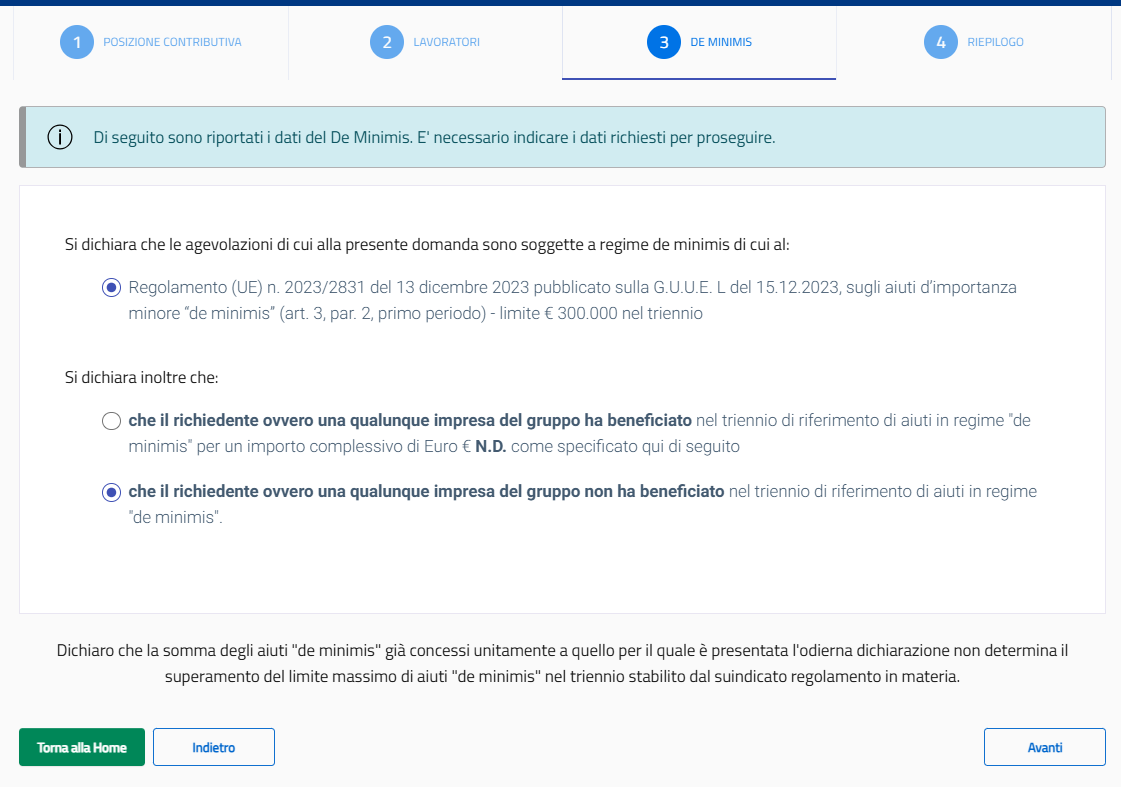

- Tab De Minimis

After entering the required data within the Workers Tab and declaring that you are a beneficiary of the de minimis aid, the following screen will be displayed:

After that, clicking on the "Avanti" button will take you to the next screen (Summary Tab). By clicking on the "Indietro" button, it will be possible to return to the previous page (Workers Tab). To return to the Home, however, it will be sufficient to press the "Torna alla Home" button

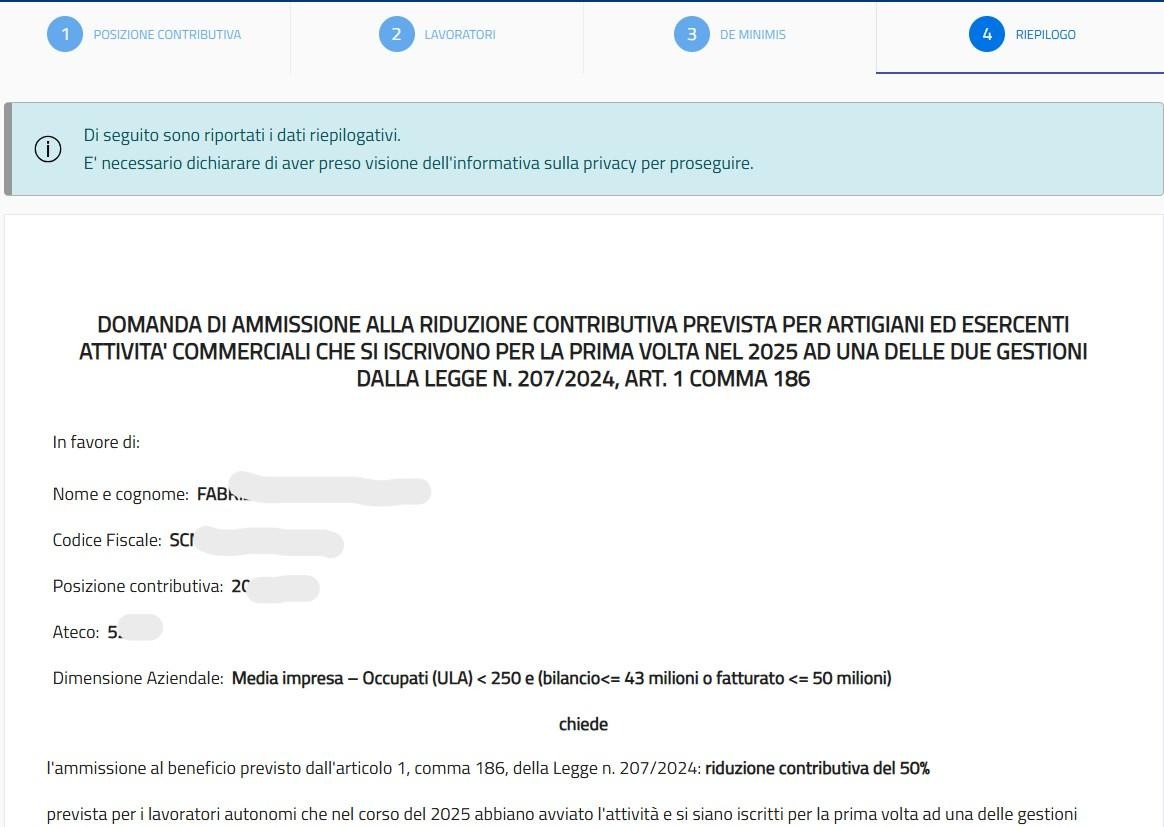

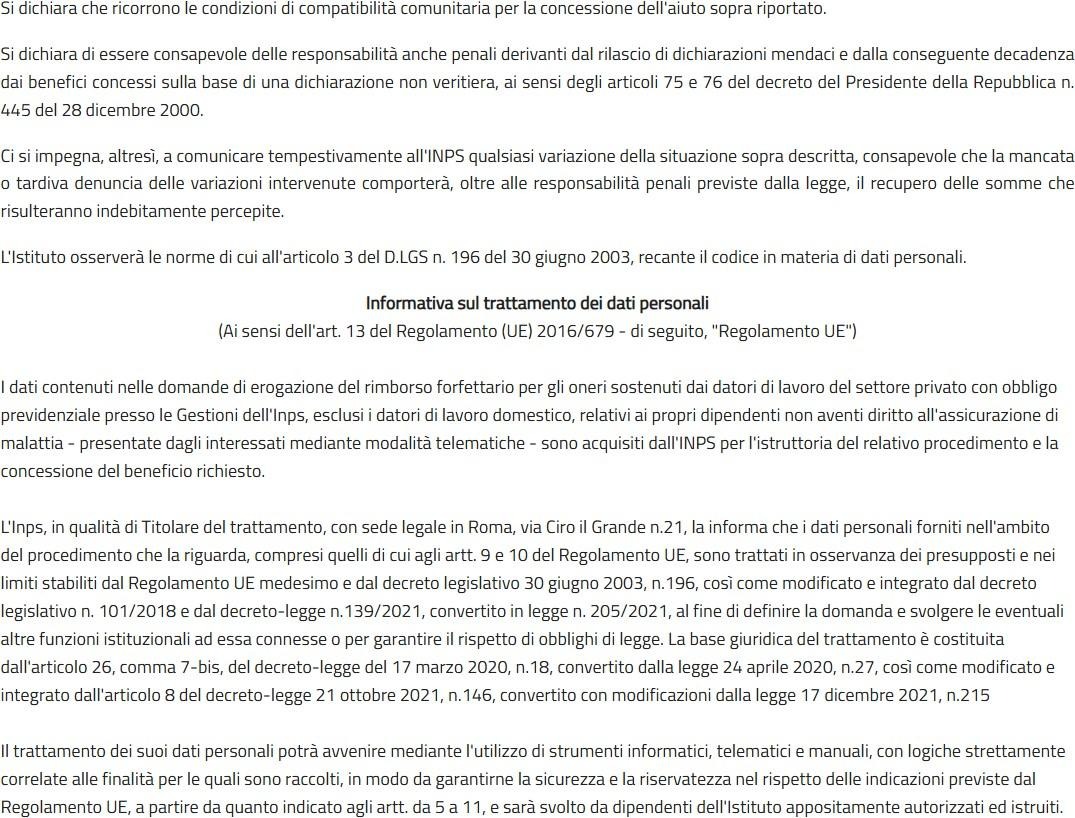

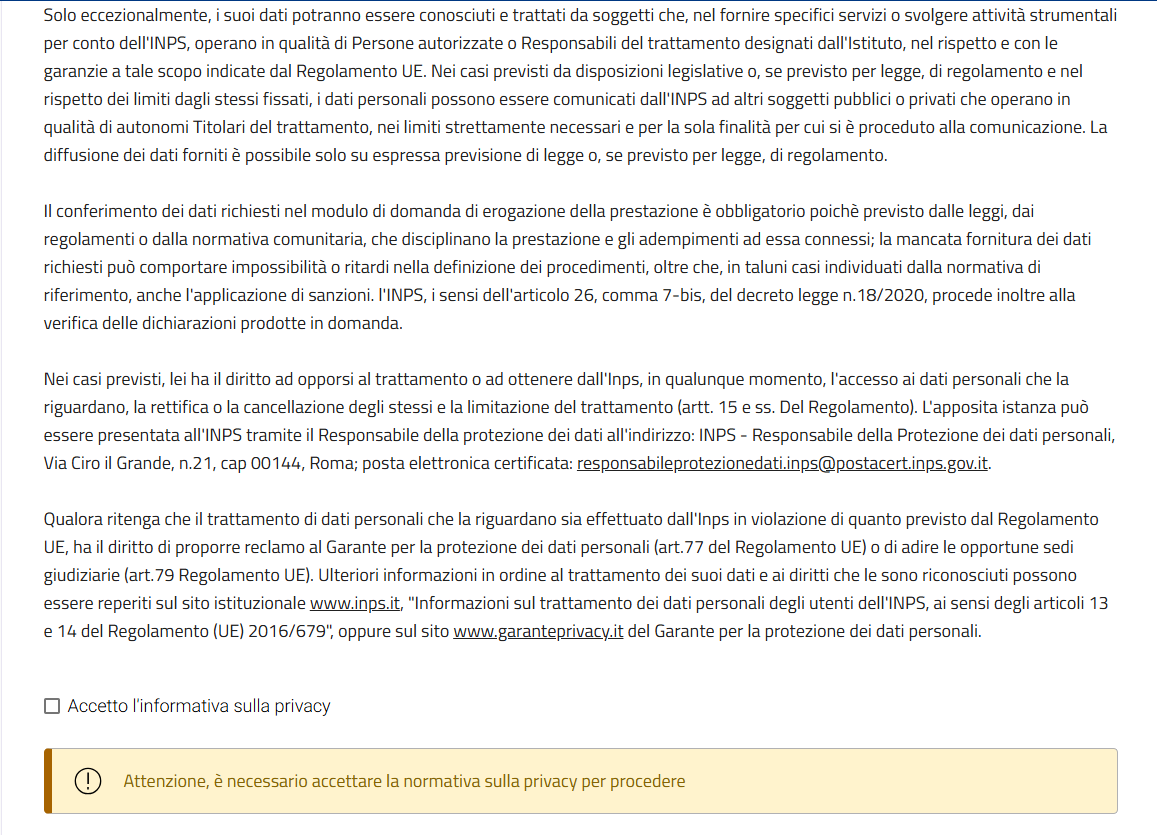

- Summary Tab

After entering the required data within the De Minimis Tab, the user will see the following screen:

In addition, you can:

- Confirm and submit the request (subject to acceptance of the conditions and selection of the "I accept the privacy policy" flag), by pressing the "Trasmetti" button positioned at the bottom of the page.

- Delete the instance by clicking on the "Elimina" and then on "Conferma" in the next pop-up:

- Download the exemption application in PDF format by clicking on the "Scarica modulo PDF" button

- Return to the previous page (Application Data Tab) by pressing the"Indietro" button.

- Viewing the question list

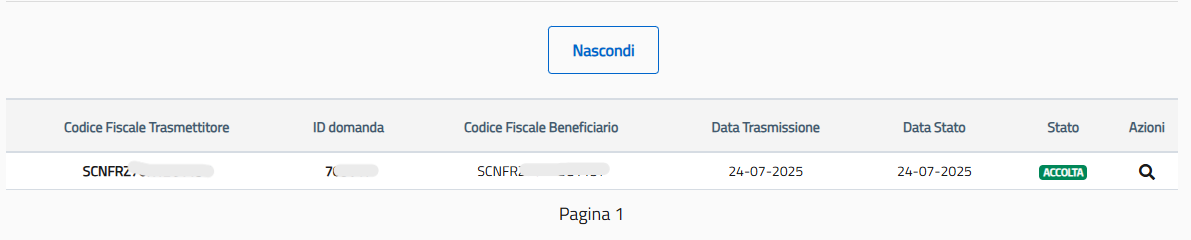

Within the home page of the relief, by clicking on the "Mostra domande" button, the user will be able to view all the questions in the INPS archives, relating to the specific incentive. In addition, for each instance in the Questions list, it will be possible to view the following information:

- Transmitter Tax Code, identification of the user who transmitted each application;

- Application ID, identification of the application number;

- Company Serial Number, i.e. the Serial Number of the company for which the application was submitted;

- Transmission Date, which indicates the date of transmission of the application;

- Status Date, which indicates the date associated with the status of the application;

- Status, which is the current status of the application;

- Actions, which allow you to view the details of an instance, complete a draft question, or delete it from the question list.

Pressing the "Nascondi" button, you can close the Questions list; To view the next or previous pages, however, just use the sliders located below it or directly select the page number you want to view.

- Detailed view of questions

The user can view the details of the question of interest by selecting it from the list of questions on the Home Page of the module and clicking on the "magnifying glass" icon located next to each instance. Based on the processing status, it will also have buttons available for the allowed functions, including the printing of the application in PDF format