For those who have started a business that requires registration in a social security position with the INPS Artisans and Traders Management for the first time in the year 2025, it is possible to request a reduction in INPS minimum contributions to 50%.

If you meet this requirement and have not yet applied for it, you can do so by following the reference guide by clicking here.

Once your application has been "ACCOLTA", INPS will have to proceed to update your"Cassetto previdenziale Artigiani e Commercianti" with the aforementioned 50% reduction. However, INPS's response times may often be delayed; therefore, until INPS has updated the F24 forms, it will be possible to recalculate the reduced amount independently by following the steps indicated in this guide.

First of all, it will be necessary to obtain the F24 form provided by INPS on your "Cassettoprevidenziale Artigiani e Commercianti", following the reference Guide by clicking here.

This recalculation procedure is essential as the code indicated in the F24 provided by INPS is a unique and identifying code of the specific installment and the specific amount to be paid, and therefore cannot be filled in otherwise than how it was generated.

Once you have the F24 provided by INPS, you can now proceed with the recalculation, again from your "Cassetto previdenziale Artigiani e Commercianti".

To access the service in question, just follow these steps:

- Access the INPS website in the reserved area using your SPID, CIE, or CNS.

- Use the search bar to search for "Cassetto previdenziale Artigiani e Commercianti".

- Once you click on the requested service, the page below will open, where you will have to access the thematic area.

Once inside, it will be possible to consult the data relating to the contribution position of the activity, including: personal data, matricula INPS, CIN code, F24 forms, contribution account statement, etc.

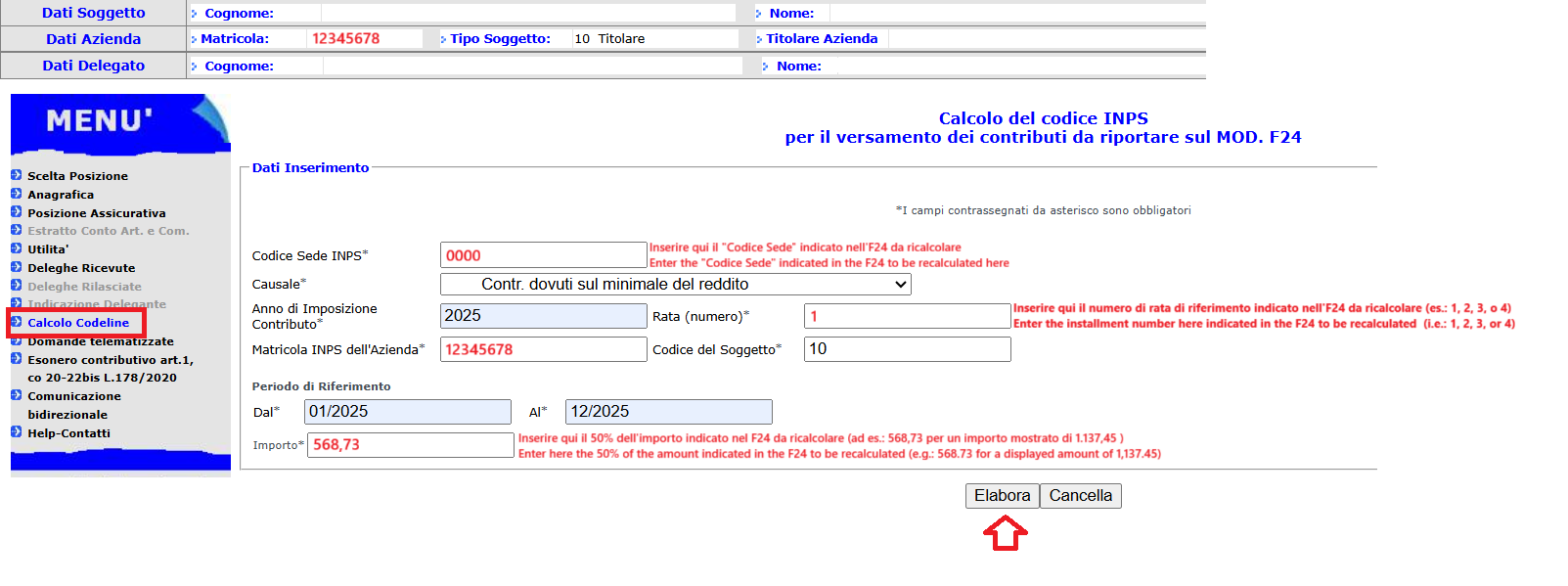

After accessing the Social Security Drawer, you will have to select the item "Calcola Codeline" from the menu on the left and proceed to fill in the various fields as shown in the image below, following the F24 of the reference installment that you want to recalculate at 50%.

Please note that the image shows purely illustrative data; it will be important to follow the instructions shown in red and take the data to be filled in directly from the F24 that you want to recalculate. In addition, the amount to be indicated must be 50% of the amount shown in the F24 previously downloaded.

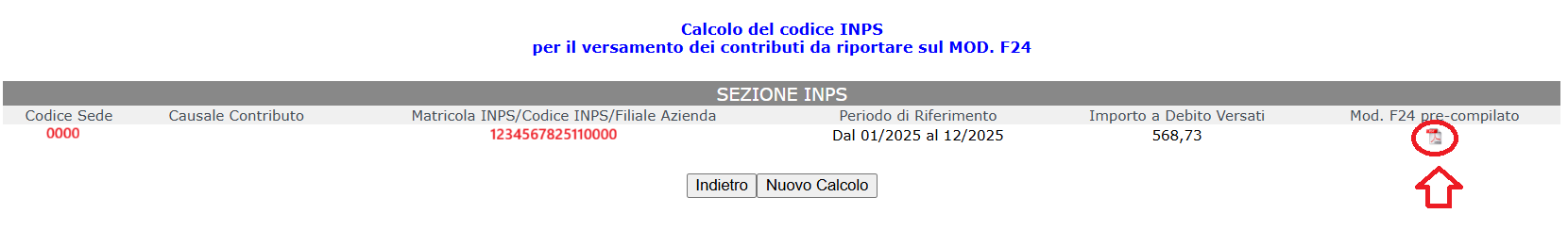

Once you have finished filling in the various fields and clicked on "Elabora", a new screen will open showing the summary of what has been recalculated, and it will also be possible to download a PDF file of the F24 draft to be paid.