The best online accounting software for freelancers

Simplify your freelance experience with Xolo. Leave the paperwork to us and focus on what's most important: Growing your business.

Why Xolo’s online accounting software?

Freelancing should be easier. While we can't eliminate bureaucracy, we can simplify it. With Xolo you save time, effort and a lot of headaches. Get ready for a hassle-free freelance experience.

Your online autónomo procedures, from start to finish

Autónomo registration, issue your first invoices, your quarterly tax returns... Everything you need. Thanks to our online platform you will be able to automate many processes, and our team of accountants will help you with the rest.

Just one platform for all your business

Issue invoices, add expenses and stay ahead of Hacienda with our tax estimation. At Xolo you can track the status of your freelance business in real time. In addition, our accountants will advise you whenever you need it.

Autónomo tax returns presented by experts

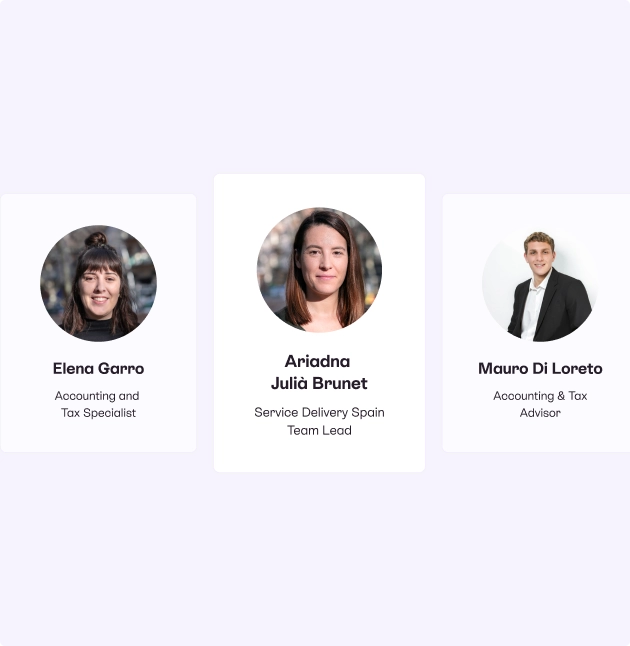

When you register with Xolo, we'll assign you your own expert who will take care of your case. They will guide you through the process, file your tax returns and recommend what's best for your business (and your finances).

Over 100K freelancers choose Xolo

How to choose the best online accounting service for your freelancer tax returns

Here's a hint: it starts with "X" and ends with "olo". Here are a couple of reasons to trust us:

We are social collaborators of the Agencia Tributaria (Spanish Tax Agency) and this allows us to carry out all the fiscal procedures for our clients.

We are social collaborators of the Agencia Tributaria (Spanish Tax Agency) and this allows us to carry out all the fiscal procedures for our clients. We are members of ASEFIGET: an association dedicated to represent and serve the tax professionals.

We are members of ASEFIGET: an association dedicated to represent and serve the tax professionals.International experts focused on Spain

An online accounting software designed for everyone. Both Spanish and foreigners. For those who invoice in Spain and inside or outside the European Union. We have experience abroad and a team specialized in the Spanish system.

Really, I only need to take care of creating my invoices and logging my expenses; beyond that, EVERYTHING IS HANDLED BY XOLO.

Mónica

Staying committed to your tax returns

At Xolo we won't run away. We don't like surprises, lies or leaving you alone when you need us the most.

All the guys are very friendly and quite approachable as they have answered to every enquiry I have had quite fast and with great accurancy. On top of everything, they can help in English which for me is extremely handy considering I live in a non english speaking country.

Stef

- Expert review. Our accountants will always make sure that everything is in order to avoid penalties.

- Responsibility. If the mistake is ours, we will stand up for ourselves and help you to solve it in the best possible way.

- Updated information. All your fiscal and business data will always be up to date. You can always rely on Xolo's platform.

We can also help you 🇪🇸

Online accounting software vs Traditional accountants

Our services and software are built to enable freelancers to do greater things, earn back more time, and spend less overall.

Online accounting software like Xolo

- Online platform to digitize your invoicing and accounting.

- Tax estimation to stay ahead of Hacienda.

- Local accountants with international experience.

- National and international invoicing from the same place.

- Automatic VAT and income tax calculation according to your activity.

- IGIC automated for those who are located in the Canarias

- Quarterly and annual tax returns.

- No unnecessary commuting.

- Extra services to grow as a freelancer (community, resources, etc.).

Traditional accountants

- No online platform. Manual invoicing and accounting management.

- No tax estimation.

- Exclusively local accountants.

- Separate management of national and international invoicing.

- Manual calculation of VAT and income tax.

- Displacement for certain procedures.

- No extra services.

FAQ about our online accounting software

To be able to use our online agency services for freelancers, you must meet a series of requirements:

- Be residents in Spain, which means that you live more than 183 days in Spain and therefore must declare your income to the Treasury. *Unless you can qualify for the impartial regime (Beckham Law)

- Be a resident in any area of the country, except the Ceuta, Melilla, the Basque Country or Navarra.

- Be professionals in those IAE categories that pay taxes under the simplified direct estimation regime.

- Not having employees.

- Not having a store or other establishment open to the public. (If you sell goods):

- Not operate with cryptocurrencies.

Our online accounting solution has two key elements: the online platform and our team of expert managers.

- Online platform. Thanks to it, you can manage your invoices, expenses and accounting directly. We have automated many of the processes (VAT and income tax calculation, for example) to make everything easier. In addition, you will be able to track your taxes and finances in real time.

- Expert accountants. We'll assign one to you as soon as you register with Xolo. Your personal manager will guide you through the process, file your taxes, answer any questions you may have and recommend what's best for your business.

Simply register with Xolo and select the "I'm already autónomo" option in your control panel. Then you’ll need to upload your registration documents (we hope you have them handy) and wait a maximum of 24 working hours until you receive an email with steps to follow.

And if you don't have the papers at hand, don't worry. We will contact your previous manager and will solve it in moments.

Depending on the plan you choose, you will have access to a series of services for your freelance activity. In addition, you can always hire another service or procedure if it is not included in your plan.

These are some of the most requested services:

- Ordinary invoice: a complete invoice that includes all legally required information.

- Simplified invoice: an invoice in which it is not necessary to include all the data of our client. You’ve likely heard it referred to as a ticket.

- Credit note: an invoice that corrects another invoice already issued. As invoices cannot be deleted, every time you make a mistake you will have to issue a rectification.

- Proforma invoice: the invoice that is given to the customer before delivering or finalizing the service. It has no fiscal value.

- Recapitulative invoice: an invoice that includes several invoices to the same customer with the value of all the services rendered.

- Electronic invoice: the evolution of the paper invoice. An invoice that requires signature through digital certificate.

You can check which services are included in each plan and the price of each additional service in our Pricing page.

Don't worry. We will call you, so you can explain the details of your case, and we can recommend a customized solution.

Start saving 24h per month with Xolo

Time is money. So if you save that many minutes a month, you're saving money — and headaches! Sign up for Xolo today and make your life easier.

Start invoicing as a freelancer in 3 steps

Create your profile in Xolo and explain to us the details of your case. This way we will know if we are a match.

Choose your plan: Starter, Global or Premium. Each freelancer has one designed for them.

Send your first invoice. Your freelance adventure has just begun.