Your annual tax return, now included in your Xolo plan

Stay compliant without stress: invoicing, accounting, expert support — and your Renta declaration — all seamlessly handled by Xolo.

Tax return (Renta) online with Xolo

At Xolo, we handle your annual Renta with the same care and expertise we apply to your day-to-day accounting. Our tax specialists stay up to date with every change in Spanish regulations to ensure your filing is accurate, optimized, and effortless.

Combined with our invoicing, expenses, and bookkeeping support, your Renta becomes part of a simple, streamlined process — tailored to your specific case by real experts.

Renta is now included as part of your Xolo subscription plan.

How Renta works with your Xolo plan

Choose your plan

Each freelancer has a plan designed for them — Starter, Global, or Premium. All of these plans support Renta filling in their subscription.

Complete your registration

Fill in your details during onboarding so we can confirm we’re the perfect match to support your business.

Hacienda: here we go

Your annual tax return is prepared, reviewed, and submitted on your behalf — accurately and on time by our tax experts.

Why file your Renta with Xolo?

Integrated with your accounting

Your invoices, expenses, and financials are already in Xolo — so your Renta is prepared with complete accuracy.

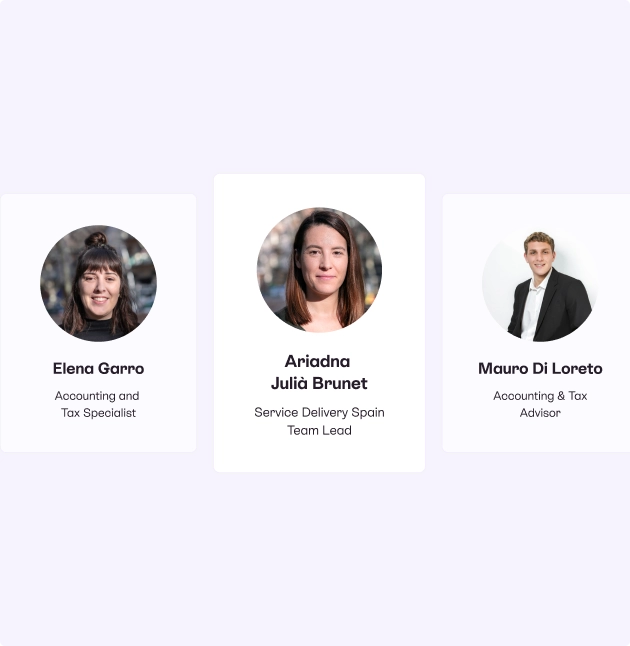

Reviewed by Spanish tax experts

Our team stays updated with every change in the law to make sure your declaration is compliant and optimized.

Tailored to your situation

We analyze each case individually to ensure you get the best possible outcome.

No extra platforms

Everything — accounting, support, documentation and your tax return — is managed from one place.

Peace of mind, all year long

You focus on your business. We’ll handle the paperwork.

Freelancing in the Canary Islands? We also file your

income tax return 🌴

With Xolo, we simplify your taxes so you can focus on your business.

Get started nowWhich freelancers have to file income tax returns

Do you want to know if you have to file the Renta as a freelancer? It's easy: there are only two criteria you have to take into account. But don't worry, with our guide to filling your income tax return, you don't have to be afraid of anything.

Freelancers

All self-employed workers (even if you earn €0) are required to present this form.

Employees

If besides being registered as autónomo, you are also an employee, it is your turn to file the Renta. All workers with two or more payers are obliged to do so.

Filing the tax return on your own vs with Xolo

There are many advantages to filing your freelance income tax return online with Xolo:

With Xolo

- ✅ You only need your ID or Passport.

- ✅ Process managed by Xolo.

- ✅ Expert managers behind every step.

- ✅ All necessary income and expenses.

- ✅ All deductions secured.

- ✅ 100% online.

- ✅ Personalized support.

Without Xolo

- ❌ Digital Certificate, Clave PIN or reference number required.

- ❌ Individual responsibility during the whole process.

- ❌ Not very intuitive Hacienda website.

- ❌ High probability of not entering necessary income and expenses.

- ❌ No guarantee of applying all deductions.

- ❌ Possible trips to the offices for a face-to-face appointment.

Only need help with your Renta?

If you're simply looking to file your annual tax return without a full subscription, Xolo also offers a standalone Renta service — prepared and submitted by our team of Spanish tax experts.

Get your Renta done quickly, correctly, and with full peace of mind.

Start with Renta filing