The invoicing tool every freelancer deserves

Easy, adaptable and always available. Manage all your invoices, clients and taxes in one place with Xolo.

100% VeriFactu-compliant. AEAT-ready e-invoicing built for Spanish freelancers.

Start invoicing without the hassle

Xolo is the top solution for freelancers both experienced and new. Thanks to our online platform you can manage everything related to your business, without worrying about the paperwork. Our team of expert accountants will be by your side to make it easy for you.

Start invoicing as a freelancer in 3 steps

Sign up to Xolo platform

Get off to a good start without complications by signing up to Xolo. Provide us with your business details and our onboarding specialist will check if we are a good match.

Create rates and budgets

Start up your business by getting new clients and defining projects. With Xolo you are able to save all your clients information and agree on the project's details in one place.

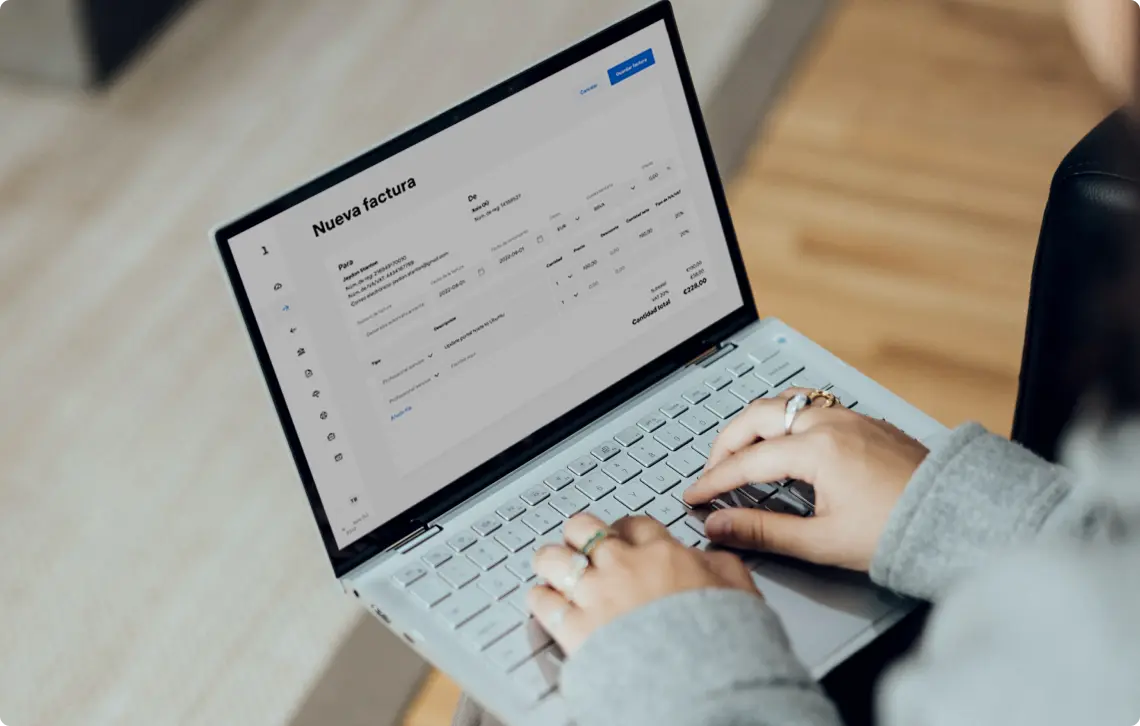

Invoice with Xolo

Creating invoices couldn't be easier. With Xolo you can generate them in a matter of minutes and send them directly to your clients. And if you have any doubts or issues, you can rely on the expert help of our accountants.

The best online invoicing software

Xolo makes choosing the right program for your needs easy, with an all-in-one solution.

Send professional invoices in less than 10 minutes

Add clients and create single or recurring invoices faster. Our customizable templates allow you to issue professional invoices in just a few clicks.

The Xolo platform works excellently and makes life as autonomo much easier. But above all the Xolo team delivers the best service. They are always quick to reply to any questions and there is nothing that they can't solve. Don't make your life harder than it has to be - Use Xolo!

Jonas

VAT on each invoice, under control

We automatically calculate the VAT for each of your invoices. Avoid problems with the tax authorities at the end of the quarter thanks to our accurate calculations.

Xolo is easy to manage, especially for people new to Spain or without any experience with the TAX and accountable system. Their system is easy to use, my invoices look professional when i send them to my customers and its easy to keep traceability on their platform.

Diana

IGIC automated for you in the Canarias

We simplify your invoicing by automatically applying IGIC rates if you are located in the Canary Islands. Our platform ensures your tax filings, including quarterly and annual IGIC reports, are accurate and on time, saving you effort and avoiding errors.

Signing up with Xolo proved to be an exceptionally seamless and quick experience. The platform is user-friendly, offering comprehensive information vital for those starting as self-employed in Spain.

Karina

National and international invoices

Whether your customers are Spanish or from elsewhere (inside or outside the EU), we got you. With Xolo you can invoice all your customers. Even in currencies other than the Euro. Our team will help you with all paperwork (intra-community VAT application) and every invoice.

All the guys are very friendly and quite approachable as they have answered to every enquiry I have had quite fast and with great accurancy. On top of everything, they can help in English which for me is extremely handy considering I live in a non english speaking country.

Stef

Online support

Our team of expert managers is always ready to assist. Let Xolo recommend what is best for your business and warn you if something is not going as it should — you’ll always be in good hands.

Really, I only need to take care of creating my invoices and logging my expenses; beyond that, EVERYTHING IS HANDLED BY XOLO.

Mónica

Xolo’s e-invoicing, now VeriFactu-compliant

Compliant with AEAT. Built for autónomos.

Spain’s new e-invoicing rules (VeriFactu) are coming—but with Xolo, you’re already ready. We’ve built a seamless invoicing experience that meets every technical and legal requirement, without adding friction to your workflow.

Every invoice includes a digital signature, secure hash, and QR code—fully aligned with AEAT standards.

Choose real-time reporting to the tax agency or keep full control—Xolo supports both modes.

Grant Xolo permission to process your invoices through VeriFactu and send them directly to the AEAT on your behalf—a quick, fully digital, and compliant process.

Invoice logs and records are securely stored and accessible in case of inspection—no extra effort on your part.

A world of advantages with Xolo invoicing

With Xolo

- Invoices, expenses and taxes in a single platform

- Clients (national and international)

- Budgets

- Faster invoice creation (national and international)

- Visibility and control over paid and unpaid invoices

- Estimation of taxes to be paid

- Integrated declaration of tax returns

Without Xolo

- Manual processes

- Lack of visibility and control over invoices, expenses and taxes.

- Non-digitization of your expenses

- No tax estimates

Discover if Xolo is right for you

To use Xolo as a freelancer for invoicing, we’re obligated to ensure customers meet some fairly simple requirements before blasting off.

-

If you’re Spanish:

- Be over 18 years.

- Have a valid ID card.

-

Residing in Spain.

- To be registered in Hacienda as self-employed and for profit (model 036 or model 037).

- To be registered in the Special Regime of Self-Employed Workers (RETA).

-

If you’re a citizen of the European Union:

- Prove that you are a citizen of the European Union, the European Economic Area or Switzerland.

- Legally reside in Spain.

- A Foreigner Identification Number (NIE).

- An economic activity registered in the Treasury (form 036).

- Be registered in the Special Regime for Self-Employed Workers (RETA).

-

If you are a non-EU foreigner:

- A residence permit.

- A work permit that allows you to work on your own.

- Have your economic activity registered in the Treasury (form 036).

- Be registered in the Special Regime for Self-Employed Workers (RETA).

In addition to complying with the requirements for invoicing as self-employed, you will have a series of obligations with Hacienda and Social Security.

- Tax Agency forms: all self-employed persons in Spain must file a series of forms throughout the year. There are quarterly (such as form 303) and also annual (such as form 390). It all depends on your activity, profits and type of services provided and contracted. But don't worry, we will notify you every time it's your turn to file one.

- Social Security self-employed quota: once you are registered in the RETA you will have to start paying your monthly self-employed quota. We explain the details of the quota in this article.

It depends on where your customer is located (especially if it is within the European Union) In that case you will need to:

- Register in the ROI (Intra-Community Operator Registration).

- Make sure that your client or supplier is also registered in ROI.

- Properly understand if you provide a service or deliver a product. The tax burden is different depending on it.

In this article you can find how to invoice international clients and succeed as a freelancer abroad.

In total, we can talk about 6 different types of invoices that a freelancer can issue:

- Ordinary invoice: a complete invoice that includes all legally required information.

- Simplified invoice: an invoice in which it is not necessary to include all the data of our client. You’ve likely heard it referred to as a ticket.

- Credit note: an invoice that corrects another invoice already issued. As invoices cannot be deleted, every time you make a mistake you will have to issue a rectification.

- Proforma invoice: the invoice that is given to the customer before delivering or finalizing the service. It has no fiscal value.

- Recapitulative invoice: an invoice that includes several invoices to the same customer with the value of all the services rendered.

- Electronic invoice: the evolution of the paper invoice. An invoice that requires signature through digital certificate.

Join over 100K freelancers who already trust Xolo

Start invoicing today. A software to control your accounting and a team of expert managers are just a click away.

Start invoicing as a freelancer in 3 steps

Create your profile in Xolo and explain to us the details of your case. This way we will know if we are a match.

Choose your plan: Starter, Global or Premium. Each freelancer has one designed for them.

Send your first invoice. Your freelance adventure has just begun.