Your personal annual income tax return — handled by experts

No matter your situation — employee, pensioner, landlord, investor, or freelancer — filing your Spanish income tax return has never been easier.

Our specialist accountants prepare your Form 100, apply every eligible deduction, and ensure your Renta is submitted accurately and on time.

- Forget the confusion

- Avoid errors.

- Maximize your return.

Trusted. Certified. Experienced.

We collaborate directly with the Spanish Tax Agency (AEAT) and are proud members of ASEFIGET — an association representing certified tax professionals across Spain.

We file Form 100 for you

We prepare and submit your official income tax return (Declaración de la Renta). Whether you're salaried, retired, renting property, self-employed or earning from investments — we make sure every detail is captured.

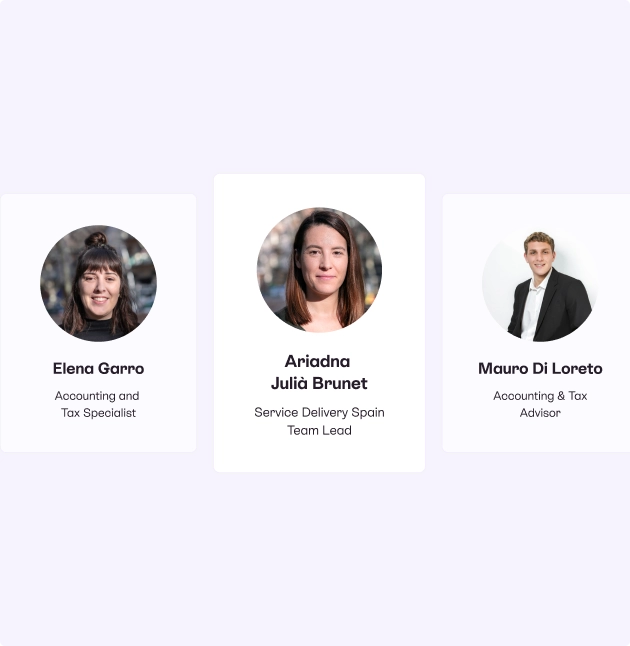

Reviewed by a real tax expert

No bots, no shortcuts. A certified Spanish accountant personally reviews your documents, prepares your declaration, and ensures full compliance.

All deductions applied

We analyse your income sources and personal situation to identify every deduction you’re entitled to — even the ones you may not know exist.

We’ve got your back — whoever you are

Whether you're new to Renta or tired of doing it solo, we make it simple.

Get started with XoloFiling the tax return on your own vs with Xolo

There are many advantages to filing your freelance income tax return online with Xolo:

Trusted by thousands of taxpayers

Sign up to Xolo, choose the Renta plan that suits you best, and we will help you with your income tax return. Leave it to Xolo and be in great hands this year.

Sign up

Tell us about your case — we'll confirm if it's a match.

Choose your Renta plan

Simple pricing with no hidden fees.

We handle Hacienda

We prepare your Renta and send it for your final approval before submission.

Frequently asked questions

Anyone who needs to file a Spanish income tax return (Form 100) — whether you're an employee, freelancer, landlord, retiree, or have investment income. We handle it all.

Our service starts from just €59 + VAT — a one-time payment with no hidden fees. The final price depends on the complexity of your tax situation, and we’ll let you know upfront.

Typically, you’ll need your ID or NIE, proof of income (e.g. payslips, invoices, rental contracts), and any documents related to deductions. Don’t worry — we’ll guide you through everything.

Yes! You don’t need to manage your freelance or business activity with Xolo to use our Renta service. Anyone can sign up.

Yes. Every Renta is personally reviewed, optimized, and submitted by one of our certified Spanish accountants. No bots, no shortcuts.

Once we receive all your documents, we will review your documents, prepare your renta and send you for a final approval before submitting it. In case we need anything else,we’ll contact you.

Absolutely. We submit your Renta directly to Agencia Tributaria (AEAT) through secure channels. Your data is encrypted, protected, and only handled by qualified professionals.