Hola, Canary Islands! 🌴

Finally, autónomos in paradise—we’re here to simplify your life as a freelancer. From invoices with IGIC to your tax filings, we take care of everything so you can focus on your business.

Sign up nowFreelancing should be different

At Xolo we want you to enjoy your independence. Forget what you've heard so far about being a freelancer in Spain and discover the accounting solution that makes it easy (and gives you more).

Press play to check it out 👉

One online platform for all your needs

Invoicing has never been easier

Create invoices and send them to your customers in minutes. Xolo lets you manage your customer base, create quotes and control the payment of invoices with ease.

Deduct expenses and save money

Xolo helps you optimize your accounts and save money every quarter. Add your freelance expenses in a couple of clicks and our team of experts will tell you if they are deductible. Get the most out of your business.

Delegate your taxes

Xolo performs tax calculations on every invoice you send, and provides an estimate of what you will need to pay. Rest easy at the end of every quarter, letting our accountants submit your tax returns in Hacienda.

Free autónomo registration*

Get off to a good start in the freelance world. Let Xolo take care of registering you in Hacienda and Social Security, choosing the correct epigraph and checking that everything is in order. In less than 24 hours you’ll be able to issue your first invoice.

*Included in Starter, Global and Premium plan if you stay 6 months in Xolo

Already registered as autónomo and looking for a superior accounting solution?

Switch to Xolo today

Our team of experts have your back

Xolo accountants are top-notch, freelancing experts. Every time you create an invoice or add an expense, count on the help of a team with more than 10 years of experience in the industry. They don't miss a beat:

Greater than just an accounting solution

Xolo gives you more. We’re here to change the way you freelance, taking care of all your paperwork and providing you the tools to focus on what's most important: your business.

Resources for every freelancer

Find the information you are looking for among all our resources. A blog, guides for every type of freelancer, FAQs... Everything you need.

Freedom in just a couple clicks:

Discover a plan tailored to you

We understand that every freelancer’s needs are different, and so we ditched the one-size-fits-all mentality – choose exactly the services your business needs to succeed.

Take a quick prequalification test

Fill out a form about you and your freelance business so we can evaluate our compatibility.

Send your first invoice

Once approved, you’re ready to invoice as a freelancer with Xolo. Enter our online platform and easily manage your business from there.

A match made in freelance heaven

Xolo is designed for and by freelancers like you. Let our online accounting solution adapt to you, not the other way around.

Our personalized service is perfect for:

- Business consultants and analysts

- Developers, programmers and other IT-related freelancers

- Marketing, advertising and PR professionals

- Journalists, copywriters or freelance writers

- Graphic designers

- Photographers or videographers

- Financial, legal, insurance and real estate consultants

- Data and statistics analysts

- Freelance teachers

- Translators or interpreters

A plan for every freelancer

Lite

This affordable plan is ideal for autónomos eager to handle their own accounting and reporting.

Starter

Sending your first invoices? This plan is ideal for those who are just starting out as freelancers and need help figuring out Hacienda.

Global

If your business knows no borders, this is the plan for you. Specifically designed for freelancers with clients and suppliers outside Spain.

Premium

For those who have been freelancing for some time. This plan helps you get even more out of your business and optimize your accounts.

All prices excluding VAT

Certified

accountants

We are social partners of the Agencia Tributaria (Spanish Tax Agency), members of ASEFIGET and use the CIRCE system: all the guarantees for you to trust us.

We have a collaboration agreement with Agencia Tributaria (Spanish Tax Agency), the government body in charge of applying and controlling the tax system.

We are members of ASEFIGET, an Association dedicated to representing and serving the tax professional.

We use the CIRCE system to carry out all the necessary autónomo procedures telematically.

⚠️ We will never ask you for your Certificado Digital (digital certificate) to do anything. Remember that it is a personal document and you should not share it with anyone.

Solos are saying...

Xolo Stories 💜

It's normal to have doubts

Choosing is not easy. Even less if it is to manage your bills, expenses and taxes. Don't play with money.

So we answer the most frequently asked questions 👇

We're much more than a gestoría: Xolo is your trusted partner in your freelance life. We combine our team of expert accountants who specialize in freelancing in Spain, with an easy-to-use online accounting and invoicing platform designed exclusively for independent professionals.

With Xolo, freelancing is just like working for a company. Don't worry about filing tax returns, filling out forms or downloading invoices for your expenses, we take care of everything, and when we say everything, we mean everything, except working for you of course.

Xolo is specially designed for those freelancers who offer professional services (not material goods) to national and international companies.

So it all depends on the activity that you develop in your business and a series of criteria that we explain here 👇

- Software developers and other IT fields

- IT experts

- Consultants, analysts or lawyers

- Marketing, advertising and communication experts

- Translators, teachers or similar

- Purchase and sale of physical products.

- Commercial activities requiring a business license

- Freelance trading of cryptocurrencies

Other criteria to take into account:

- Be a resident in Spain, (if you live more than 183 days in Spain, you must declare your income to the Tax office.) *

- Not reside in the Ceuta, Melilla, the Basque Country or Navarra.

- Be part of the IAE categories that pay taxes under the simplified direct estimation regime.

- Not having employees.

*Unless you can qualify for the impatriate regime (Beckham Law)

If you are a Xolo Starter, Global or Premium user, you have virtually nothing to worry about. We take care of everything and the process on the platform is automatic:

- Automatic calculation of taxes on each invoice. Every time you issue a new invoice, our platform will automatically add the corresponding taxes. We always take into account all the factors that can affect this calculation so that we don't make mistakes.

- Real-time tax forecast. Whenever you log in to your Xolo profile, you can always check how much you will pay on your next tax returns. We take into account all your income and expenses so you can better organize your finances.

- We file your taxes for you. You don't have to worry about anything. Our expert accountants will take care of all the paperwork every quarter and you won't have to do a thing. That's what your accountants are for, right?

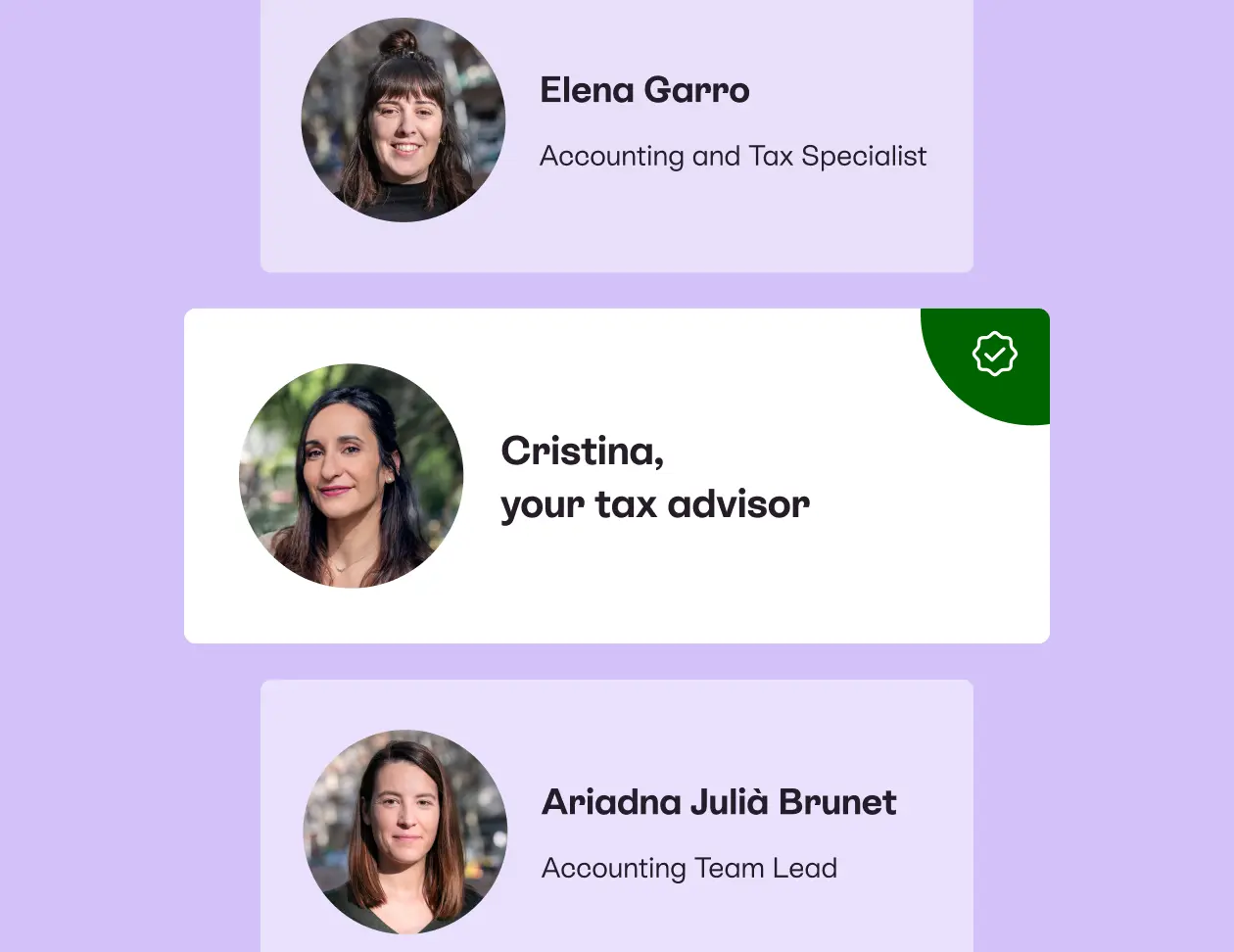

Of course. At Xolo we have a commitment to every freelancer who chooses us.

Unlike other online accounting services, Xolo will assign you an expert freelance accountant from the moment you sign up to take care of your case. No need to explain the same thing to 5 different people every time you need something.

If you have any questions or problems, you can write to your accountant and they will contact you directly. No predetermined answers or "We'll be back in 7 days".

Our commitment goes beyond a couple of nice words. If you have a problem with Hacienda or Social Security and the mistake is ours, we take responsibility. We are here to help you.

Except for Xolo Lite plan

Xolo is also the perfect option for those who have been independent for a long time and are looking for a change of accounting service (you won't regret it, promise!).

We know that changes can be tricky (especially with providers that don't make it easy for you), so if you give us your consent we will take care of the transfer.

If you prefer, you can also do it yourself 👇

- Enter the platform and choose the option "I am already autónomo".

- Sign up in Xolo.

- We will ask you for your self-employed registration documents to check that everything is in order and other important information about you and your activity.

- The last step is to verify your identity, fill in your personal details and sign the contract with Xolo.

Join more than 100,000 freelancers who already delegate their paperwork

It's time for you to live the freelance experience you deserve: total independence, free of bureaucracy. Join a new way of managing your business with Xolo and never worry again.