Last updated: August 30, 2024

These are deductible expenses but do not have an invoice, so another supporting document will have to be used.

How to justify them?

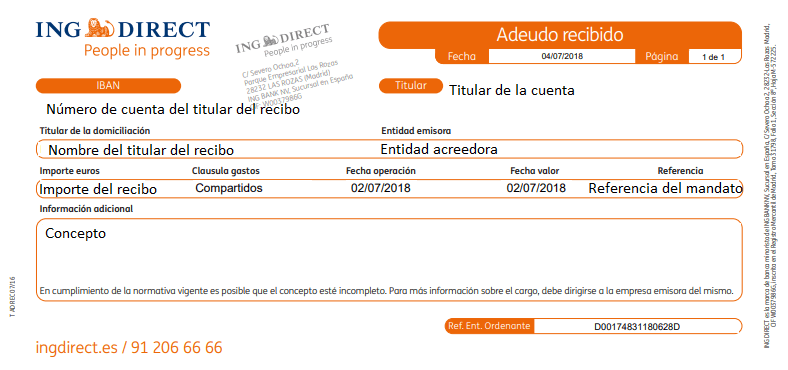

It can be deducted by submitting a bank statement with the transaction details.

Example:

Health insurance

Health insurance is, along with liability and vehicle insurance, one of the few deductibles for the self-employed.

Requirements

The policy must be registered in the freelancer’s name

Limited to EUR 500.00 per year if you are the only insured, plus EUR 500.00 per household member (spouse and/or child under 25) whose annual income is not higher than the annual minimum wage. This limit rises to EUR 1,500.00 if the household member has a disability.

If you have health insurance with copayments, these will not be deductible

Did this answer your question?